Teaching kids about money is the first step in forming financially responsible adults. Nowadays, you can help them learn with a series of apps for financial education.

Compiled by Insiderbits, this list showcases online tools that build essential money skills, offering a fun and interactive way for kids to learn about earning, saving, and even investing.

Explore with us and see how kids’ budgeting can be both entertaining and educational, laying the groundwork for a strong financial foundation.

Related: Family Well-being: Apps for Busy Moms and Dads

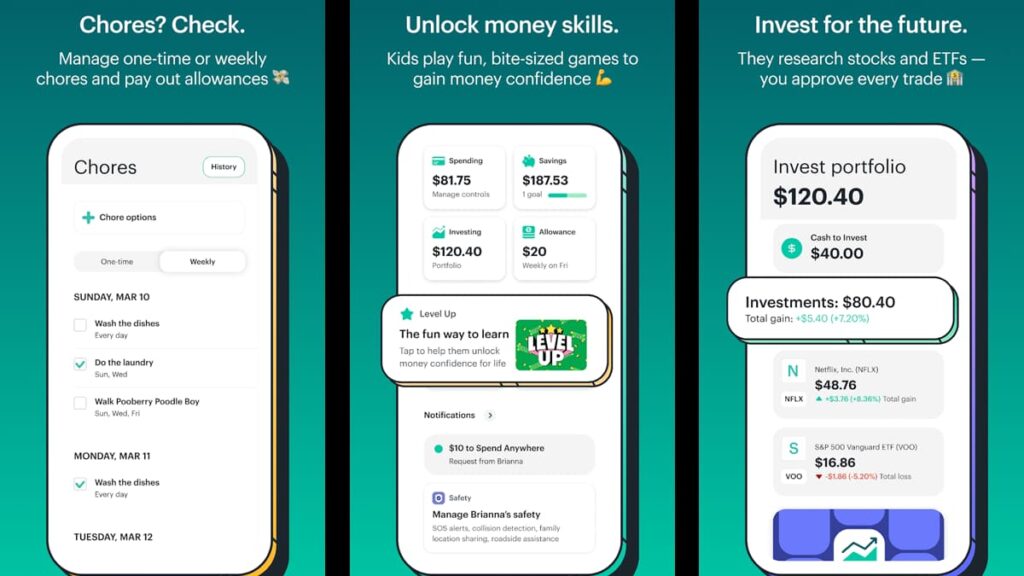

Greenlight Kids & Teen Banking

Greenlight Kids & Teen Banking app makes financial education fun and practical, with over 6 million parents and kids already navigating money matters in the United States.

When it comes to kids’ budgeting, this app offers hands-on experience. Parents can set savings goals, and control spending, and kids earn rewards through smart saving.

Building money skills comes naturally as teens learn to manage their finances, from receiving instant money transfers to handling their first debit card.

This financial resource goes beyond banking, with features like credit building for teens, cash back for parents, and educational games to improve financial literacy.

Greenlight’s comprehensive tools, including real-time notifications and spending limits, ensure a safe, educational financial journey for all kids and teenagers.

4.7/5

Highlights from Greenlight Kids & Teen Banking

- Hands-On Financial Education: Greenlight offers a real-world approach to teaching kids about money, combining practical experience with fun learning.

- Effective Kids’ Budgeting: Set and track savings goals, manage allowances, and reward smart saving habits, fostering responsible financial behavior.

- Developing Money Skills: Teens learn money management through their own debit cards, with parents setting flexible controls for a guided experience.

- Additional Financial Features: Includes options like credit building for teens and cashback rewards, enriching the overall financial learning journey.

- Safe and Secure: Real-time spending notifications and limits ensure a safe banking experience, making financial education both secure and engaging.

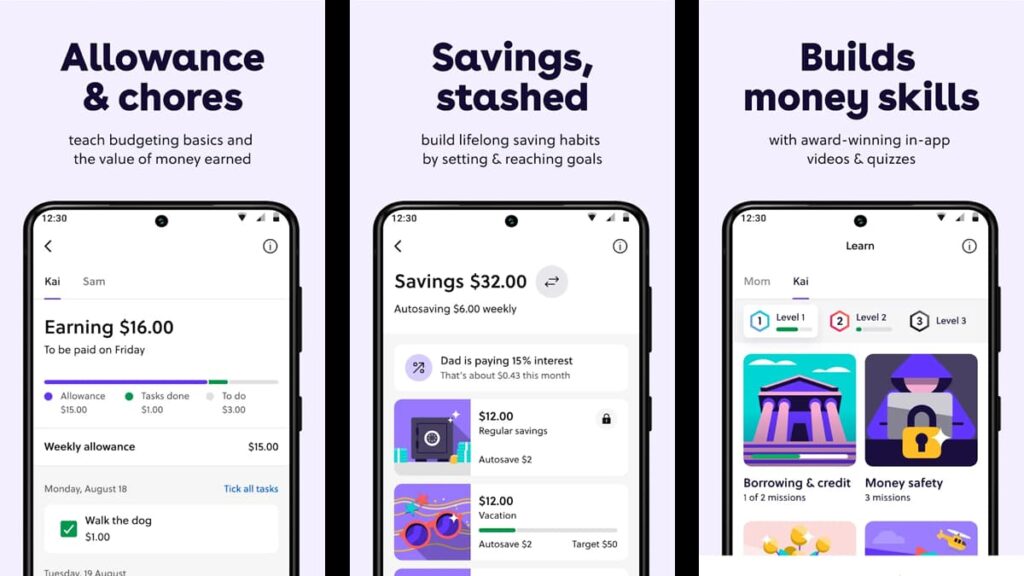

GoHenry

GoHenry Youth Debit Card & App is also a fun, interactive way for young people aged 6-18 to learn about financial education, budgeting, and spending.

Kids’ budgeting is made easy with customizable debit cards and a series of in-app tools, allowing families to learn banking basics in a real-world setting.

The app teaches money skills through gamified quizzes and videos, making financial learning an engaging and effective process for young people.

GoHenry also offers unique features like motivational chores and quick transfers, linking money management with practical life lessons and family activities.

With real-time spending visibility and savings goals, GoHenry provides a comprehensive financial education platform for young minds to help them become responsible with money.

4.1/5

Highlights from GoHenry

- Interactive Financial Learning: GoHenry combines fun and education with gamified quizzes and videos, enhancing kids’ financial literacy and money skills.

- Customizable Debit Cards: Tailor cards for young ones to learn real-world spending, providing a hands-on approach to financial education and budgeting.

- Incentivized Chores Feature: Linking chores to earnings teaches the value of hard work, making financial education practical and relatable for kids.

- Savings Goals and Visibility: Set and monitor savings targets, teaching kids about budgeting and the importance of saving, with parent-paid interest options.

- Real-Time Spending Notifications: Parents have instant visibility of spending, ensuring a safe learning environment for kids to develop money management skills.

Related: This App Simplifies Parenting

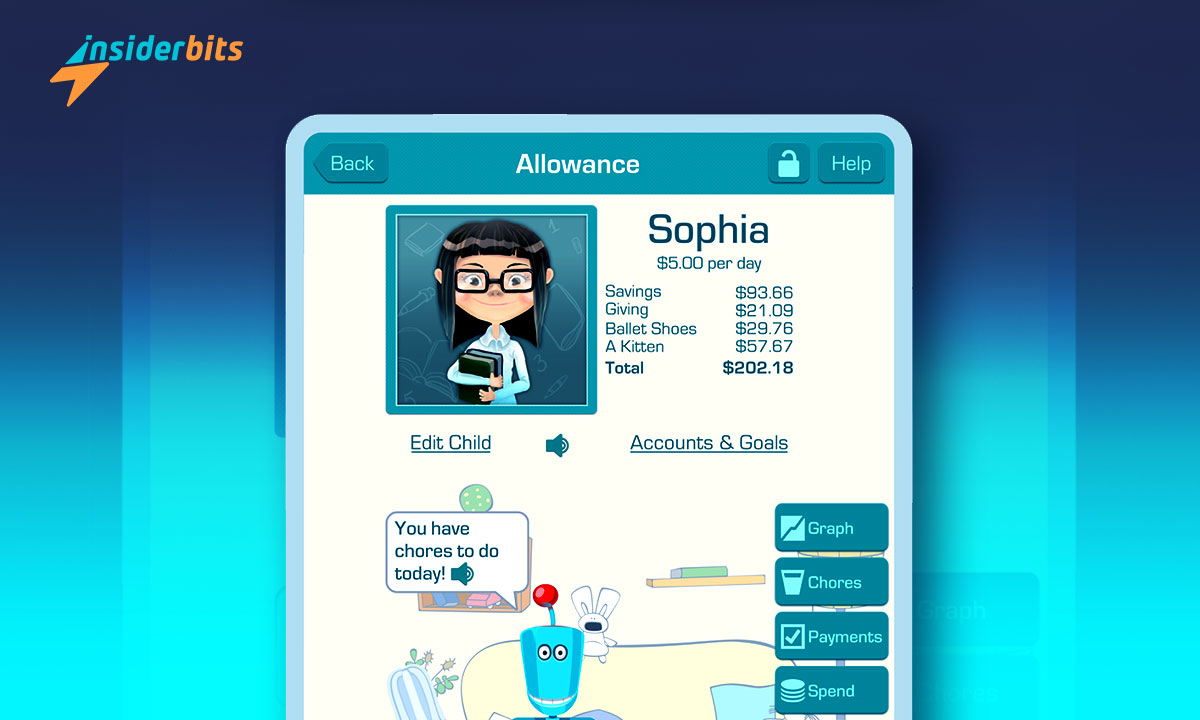

Chores & Allowance Bot

Third in our list, Chores & Allowance Bot is a dynamic app that combines fun with financial education, helping kids learn the value of work and money management.

This app simplifies kids’ budgeting by tracking chores, allowances, and their savings goals, making it easy for children to understand financial basics.

With features like syncing across devices and customizable chore lists, the Chores & Allowance Bot app is the perfect tool for teaching essential money skills.

For safety, parents can control allowance disbursement and track their kids’ spending, ensuring a balanced approach to financial literacy and responsibility for children.

Chores & Allowance Bot’s interactive design and optional subscription help to improve the learning experience for the young ones, making financial management engaging for children.

| Pricing: | Free, but there is a premium monthly plan for $9.99 that unlocks additional features. |

| Available For: | Android and iOS. |

4.5/5

Highlights from Chores & Allowance Bot

- Fun Learning Interface: Engages kids in financial education with a fun, interactive approach, linking chores to money management effectively.

- Comprehensive Tracking: Manages chores, allowance, and savings goals in one place, simplifying kids’ budgeting and helping them understand finance basics.

- Sync Across Devices: Keeps chore lists and allowances updated across all family devices, ensuring seamless management of money skills and tasks.

- Parental Controls: Allows parents to oversee allowance distribution and monitor spending, balancing financial education with real-world responsibility.

- Customizable Experience: Offers a range of features like chore rotation and savings goals, making it adaptable to each family’s financial teaching needs.

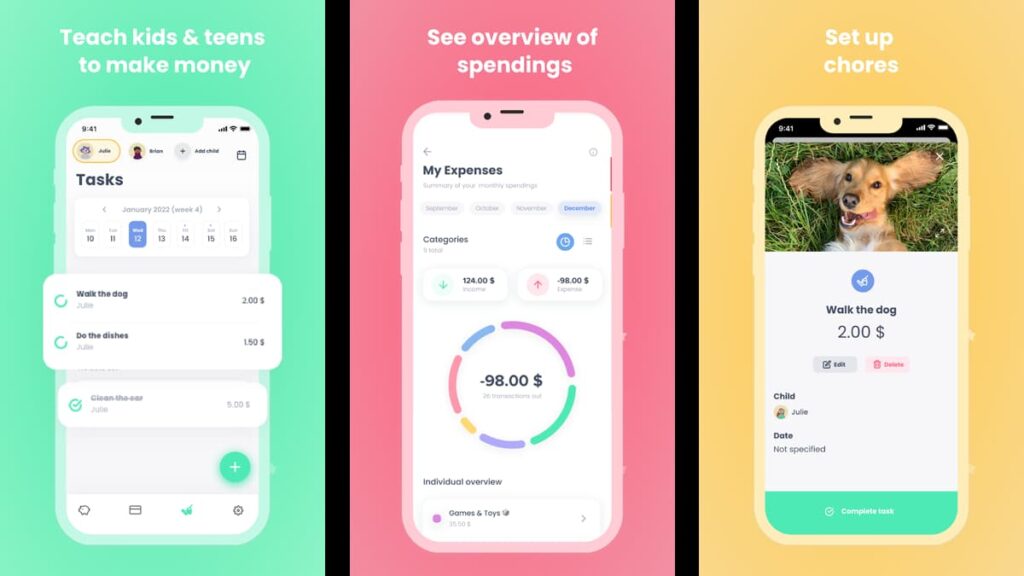

MyMonii: Pocket Money for Kids

MyMonii: Pocket Money for Kids is an all-in-one app that makes financial education fun and accessible for all families, automating their children’s allowances and savings.

Kids can learn the importance of earning through household chores. MyMonii helps them develop money skills by rewarding their contributions at home.

The app also emphasizes the significance of kids’ budgeting. It teaches young ones to save for goals, developing patience and financial responsibility from an early age.

MyMonii is a comprehensive chores tracker, integrating household tasks into financial learning, showing kids the value of hard work and money management in a fun way.

Your kids can truly mature and learn healthy money habits with MyMonii. The app offers a clear view of earning, saving, and spending, improving the financial literacy of the whole family.

| Pricing: | Free, but you can subscribe to access additional features. Plans start at $7.99 per month. |

| Available For: | Android and iOS. |

4.1/5

Highlights from MyMonii

- Automated Allowances: Streamlines kids’ financial education by automatically managing allowances, making it easier for parents to teach budgeting.

- Earning Through Chores: Integrates chores into the app, teaching kids money skills as they earn pocket money for completing household tasks.

- Savings Goal Feature: Encourages kids’ budgeting and saving habits, helping them set and achieve financial goals while learning the value of patience.

- Comprehensive Chores Tracker: Combines task management with financial learning, showing kids the real-world value of work and money management.

- Overall Financial Overview: Provides a clear view of earnings, savings, and spending, enhancing financial literacy for both kids and parents.

Related: 5 Best Budgeting Apps For Couples to Manage Money Together

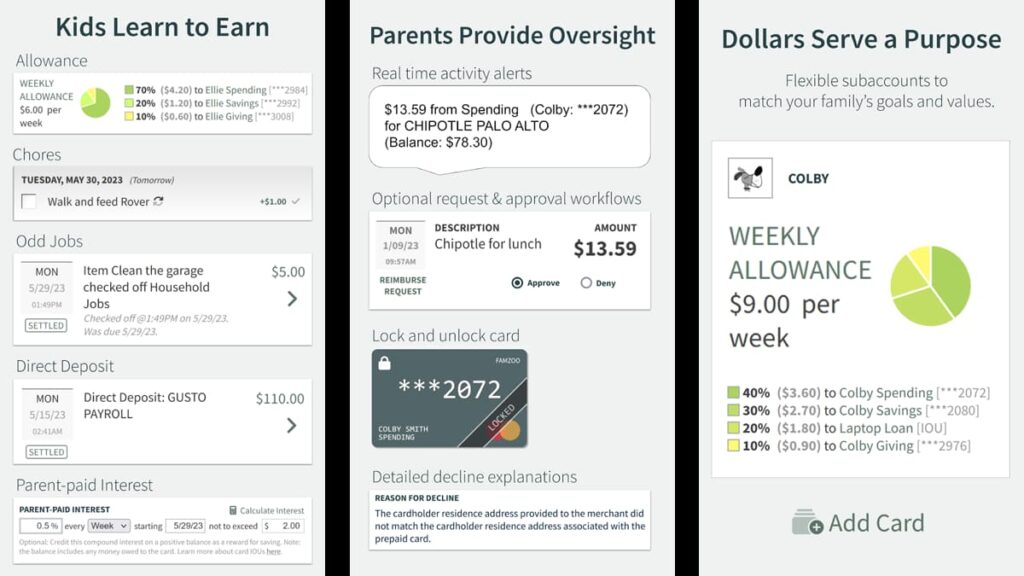

FamZoo

Lastly, FamZoo is an award-winning solution for relaying financial education to kids and teens, offering prepaid cards linked to an app. It’s a lesser-known app, but an important one.

This financial tool simplifies kids’ budgeting and money management, teaching them to spend, save, and give to charity responsibly and with parental guidance.

FamZoo is ideal for all ages, helping all users avoid debt and overspending with a series of built-in features. It’s perfect for managing allowances, and chores, and setting money goals.

You can transfer money instantly between family members for emergencies, online purchases, or managing allowances, making money skills practical and easy.

FamZoo also teaches valuable financial lessons for your kids’ future, like the power of compound interest and the importance of hard work, budgeting, and charitable giving.

4.7/5

Highlights from FamZoo

- Award-Winning Financial App: FamZoo offers an engaging platform for financial education, combining prepaid cards with a feature-rich app.

- Budgeting and Spending Tools: Simplifies kids’ budgeting and spending, teaching responsible money management with hands-on experience.

- Instant Money Transfers: Facilitates quick and safe money transfers between family members, perfect for emergencies and everyday use.

- Comprehensive Money Management: Manages allowances, chores, and budgets, helping kids develop essential money skills in a real-world setting.

- Empowering Financial Lessons: Teaches the value of compound interest, budgeting, and charitable giving, fostering a well-rounded financial understanding.

The Best Financial Education Apps for Kids – Conclusion

In conclusion, we have explored a series of incredible apps that make financial education engaging and practical, perfect for teaching kids about money.

From tracking allowances to learning about savings, these financial resources are important for developing essential money skills and responsibility in young minds.

Specially crafted by Insiderbits, this curated selection aims to help you find the best tools for passing on financial knowledge and kids’ budgeting skills in the digital age.

And if you’d like to learn more about the best tools and tips to assist you in your kids’ development, we have plenty of articles waiting for you at Insiderbits. Come explore with us!