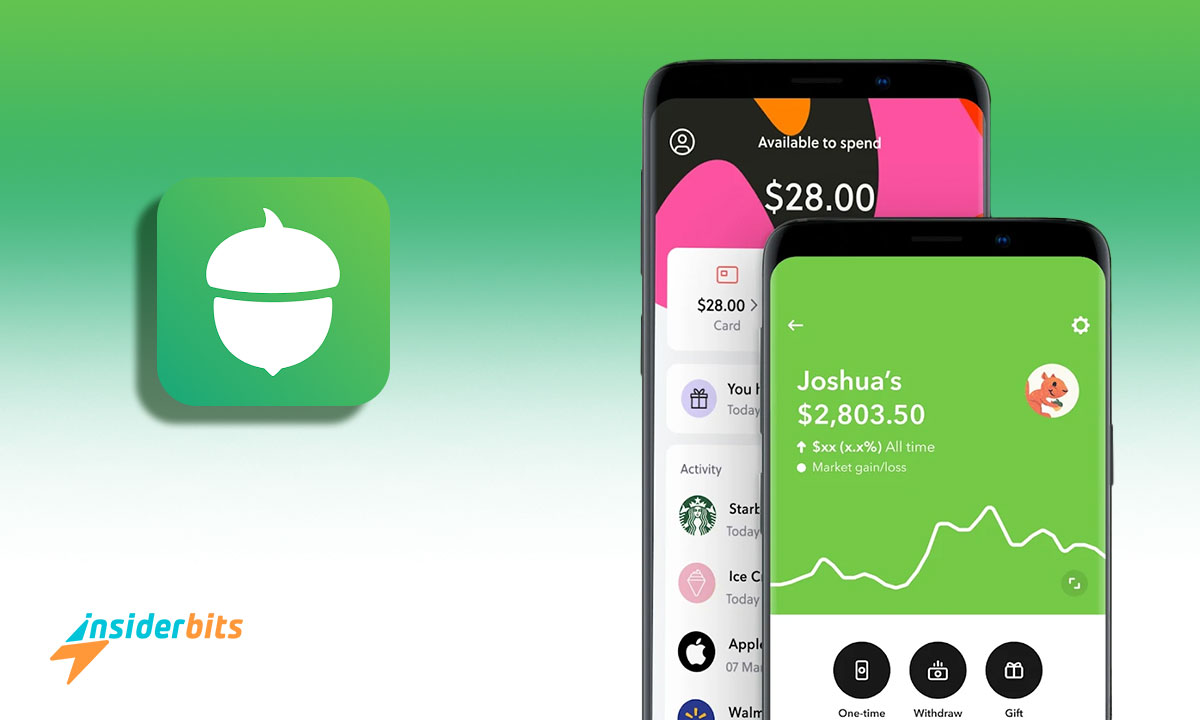

In a world where financial literacy and saving for the future are paramount, the Acorns app emerges as a beacon of hope for individuals seeking to grow their wealth through intelligent saving and investing. With its user-friendly interface and innovative features, Acorns revolutionizes the way people approach their finances.

By seamlessly integrating micro-investing with everyday spending, Acorns empowers users to effortlessly save and invest their spare change, turning small amounts into significant financial growth.

Join us as we delve into the world of Acorns, exploring how this app is reshaping the landscape of personal finance and helping individuals secure a brighter financial future.

Acorns App – Review:

Acorns is a revolutionary app that caters to both new investors and those looking to start with small amounts. With a minimal investment requirement of just $5, Acorns allows users to build a diversified portfolio using ETFs tailored to their goals and risk tolerance.

One standout feature is the “round-up” functionality, where spare change from everyday purchases is automatically invested, fostering good saving habits. Additionally, Acorns offers a high-yield checking account earning 3% APY and a savings account earning 5% APY, with no minimum balance required for these attractive interest rates.

The app’s user-friendly interface and straightforward pricing make investing easy and accessible to all. Acorns’ automated savings tool sweeps excess change from transactions into an investment portfolio, encouraging users to save effortlessly.

Moreover, Acorns provides cash-back rewards at over 450 retailers, enhancing the overall saving and investing experience.

While Acorns excels in simplifying the investment process and offering innovative features like cash-back rewards and automated round-ups, it does have some limitations.

One notable drawback is its tiered fee structure, which may pose challenges for newer investors with small portfolios. Additionally, Acorns lacks tax strategies like tax-loss harvesting, a feature offered by many competitors.

How to Download Acorns App?

To download the Acorns app on Android and iOS, follow these step-by-step instructions:

Android용:

- Visit the Google Play Store.

- Search for Acorns: Save & Invest in the search bar.

- Click on the app developed by Acorns.

- Tap on the Install button to download the app to your Android device.

- Once the installation is complete, open the app and follow the on-screen instructions to set up your account and start investing.

iOS용:

- iOS 기기에서 앱 스토어를 엽니다.

- Use the search function to look for Acorns: Save & Invest.

- Locate the app developed by Acorns and tap on “Get” to download it.

- After the installation is finished, launch the app and proceed with setting up your account as guided within the application.

4.7/5

How to Use Acorns App?

To use the Acorns app effectively, follow these step-by-step instructions:

Sign Up and Create an Account:

Follow the prompts to set up your account with personal information and financial goals.

Link Your Bank Account:

Connect your bank account securely to Acorns to enable round-up investments and transfers.

Choose Your Investment Strategy:

Select your investment portfolio based on your risk tolerance and financial objectives.

Enable Round-Ups:

Activate the round-up feature to automatically invest spare change from everyday purchases.

Set Up Recurring Investments:

Opt for recurring investments to regularly contribute additional funds to your portfolio.

Explore Additional Features:

Discover Acorns Later for retirement savings, Acorns Checking for digital banking, and Acorns Early for kids’ investment accounts.

Monitor Your Investments:

Keep track of your portfolio performance, contributions, and potential earnings within the app.

Utilize Educational Resources:

Take advantage of Acorns’ educational tools and resources to enhance your financial knowledge and decision-making.

Smart Saving and Investing Tips

Start Early and Consistently: Begin saving and investing as early as possible to benefit from compound interest over time. Consistency is key; even small, regular contributions can lead to significant growth.

Automate Savings: Set up automatic transfers from your checking to savings accounts to ensure consistent saving habits. Utilize apps like Digit or Qapital for effortless savings automation.

Understand Your Risk Tolerance: Evaluate your risk tolerance to align your investments with your comfort level. Higher returns often come with higher risks, so choose investments accordingly.

Take Advantage of Employer Matching: If offered, maximize employer retirement plan matching contributions for free money towards your future. This matching contribution can significantly boost your retirement savings.

Educate Yourself: Learn about different investment options, financial tools, and strategies to make informed decisions. Stay informed through online resources, classes, or consultations with financial advisors.

Set Clear Financial Goals: Define specific short-term and long-term financial objectives to guide your saving and investing efforts. Having clear goals helps motivate saving and provides a roadmap for financial success

4.7/5

Acorns App: Grow Your Wealth with Smart Saving and Investing – Conclusion

Acorns app stands as a beacon of innovation in the realm of personal finance, offering users a seamless and accessible way to grow their wealth through smart saving and investing.

Through features like round-ups, diversified portfolios, and educational resources, Acorns simplifies the investment process and encourages a disciplined approach to saving.

As we navigate the complexities of modern finance, Acorns serves as a valuable tool for those looking to build a brighter financial tomorrow.

관련: The Best Alternatives to the Robinhood Investment App

이 글이 마음에 드셨나요? 인사이더비츠 블로그를 즐겨찾기에 추가하고 기술 등에 관한 새롭고 흥미로운 정보를 얻고 싶을 때마다 방문해 주세요!