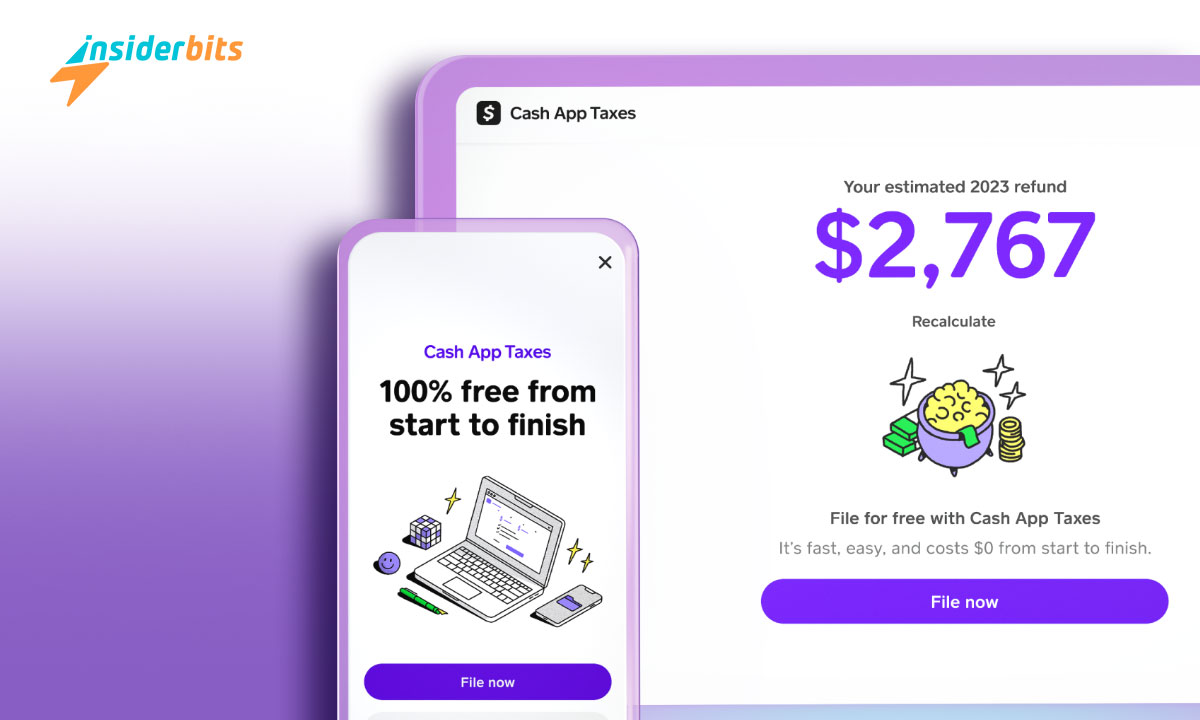

Cash App Taxes offers a refreshing approach to tax season, transforming the often demanding task of filing taxes into a smooth, hassle-free experience.

This review by Insiderbits takes a closer look at how this all-in-one tax platform challenges the norms of financial apps with its simplicity and commitment to being cost-free.

Stepping into the realm of free tax filing has never been easier! Read on to experience Cash App Taxes and its promise of peace of mind without the price tag.

関連記事 キャッシュアプリでタップひとつで経済的自由を手に入れる

An in-depth Cash App Taxes overview

The Cash App Taxes website offers a seamless experience for those looking to navigate the often complex world of taxes. Its design ensures you find information swiftly and accurately.

As a leading tax platform, it promotes empowerment through educational resources. The website is packed with advice, making free tax filing approachable for everyone.

What sets this website apart is its commitment to no-cost filing. The site clearly explains how Cash App Taxes maintains this promise, offering transparency on its tax service.

The website also features a FAQ section to address concerns and questions. This resource is invaluable for users looking for quick answers about the platform and its offerings.

Finally, Cash App Taxes integrates with the Cash App ecosystem. Users can easily navigate from tax filing to managing their assets, all while enjoying a solid digital finance experience.

| 価格設定: | 無料だ。 |

| 利用可能 | ウェブ. |

Is Cash App Taxes available for everyone?

Cash App Taxes is designed to be accessible for everyone, offering free tax filing services to both federal and state taxpayers. However, eligibility may vary based on specific situations.

While the platform aims to cater to a wide range of users, some complex tax scenarios might require additional guidance not available through the platform.

Additionally, to use Cash App Taxes, you must have a Cash App account. This requirement means downloading the Cash App on your mobile device and signing up for their services.

What are the best Cash App Taxes features?

In today’s digital age, filing taxes online has become the norm, and Cash App Taxes is leading the charge with its innovative features.

From comprehensive coverage to fast refund processing, let’s explore the standout features that make this website one of the best choices for taxpayers.

- 包括的な補償: Cash App Taxes support a wide variety of tax situations, from simple W-2 income to more complex scenarios.

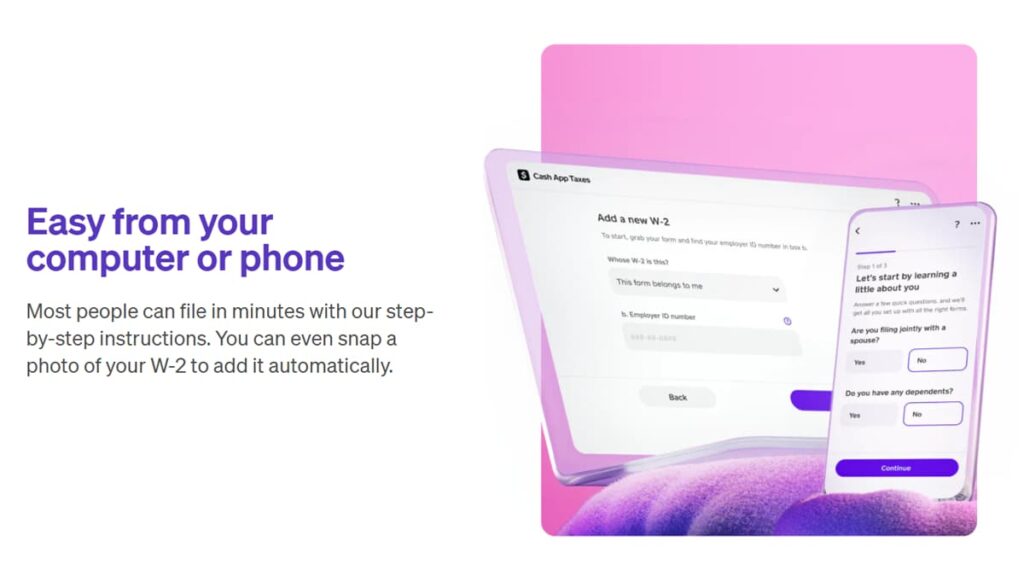

- ユーザーフレンドリーなインターフェース: The platform is designed with clarity and simplicity in mind, making it easy for users to navigate their taxes without feeling overwhelmed.

- Cost-Efficiency: Emphasizing free tax filing, it guarantees that users won’t face any hidden charges, regardless of the complexity of their tax returns.

- Security Measures: With powerful encryption and security protocols, this tax platform ensures that all user data is protected, offering peace of mind.

- Fast Refund Processing: By depositing your tax refund directly into your Cash App account, users can access their funds up to five days earlier than traditional banks.

Focusing on simplicity, security, and speed, Cash App Taxes ensures a stress-free tax filing experience, whether you’re navigating simple or complex tax situations.

関連記事 Intuit Credit Karmaで財務を強化しよう

What about the limitations of Cash App Taxes?

Cash App Taxes presents a seamless and cost-free solution for many. However, even the most refined systems have their limitations.

Let’s uncover some areas where the platform may fall short for certain users, providing a balanced view of its capabilities alongside the praised features.

- Limited Support for Complex Issues: Users with hard tax situations might find the platform less useful, lacking the depth of guidance from specialized tax services.

- Dependency on Cash App: Accessing the platform’s free tax filing requires a Cash App account, limiting its availability to those not willing to join Cash App.

- No Professional Review: Unlike some tax platforms, it doesn’t offer an option for a professional review, which can be a critical need for users with complex tax profiles.

- State Filing Restrictions: Some users might find restrictions for specific state tax filings, which can be a significant inconvenience depending on their location.

- Feature Limitations: The platform may not support every tax form or situation, potentially excluding those with very specific tax filing needs.

Despite these drawbacks, Cash App Taxes remains an excellent player in the arena of online tax filing, offering a valuable service for many.

Its approach to free tax filing democratizes access to tax services, but it’s clear that some complex situations and user preferences may need looking beyond its offerings.

Easy steps to create a Cash App account

To have access to free tax filing with Cash App Taxes, the first step is setting up a Cash App account. This process unlocks a user-friendly platform that simplifies tax season.

If you’re not sure how to begin, here’s how to create your account, step by step, ensuring you’re ready to navigate your taxes with confidence.

- アプリをダウンロード Begin by downloading Cash App from your mobile device’s app store. It’s available on both iOS and Android platforms, ensuring wide accessibility.

- Open and Register: Launch the app and enter your email address or phone number, which Cash App will use to send you a verification code.

- Verify Your Account: Upon receiving the verification code via email or SMS, enter it in the app to confirm your contact information and proceed.

- Link a Bank Account: For a complete experience, including receiving tax refunds through Cash App Taxes, link your bank account by following the app’s instructions.

- Personalize Your Account: Customize your Cash App account by choosing a $Cashtag, which serves as your identifier for transactions and receiving money.

- Add Personal Information: Complete your profile by adding personal information such as your name and Social Security Number, crucial for tax filing purposes.

With a Cash App account, you’re paving the way for a streamlined experience with Cash App Taxes, combining financial management and tax filing in one convenient platform.

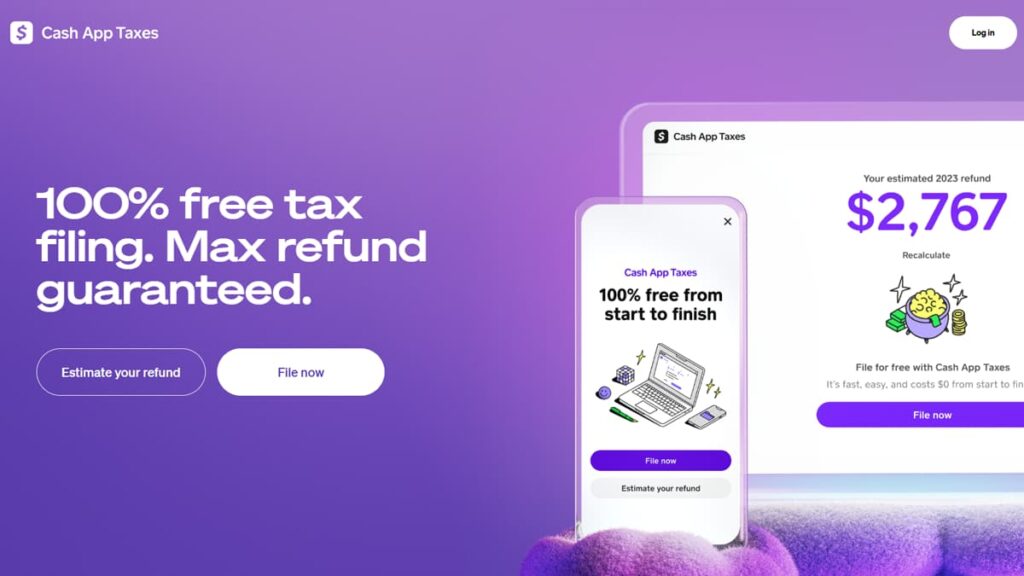

How to navigate the Cash App Taxes website

With its user-friendly interface and commitment to free tax filing, Cash App Taxes ensures an easy and straightforward process for an otherwise demanding task.

To make sure everything is done correctly, follow this detailed guide to navigate the website efficiently, ensuring a stress-free tax season from start to finish.

Accessing Cash App taxes

To begin, visit the Cash App Taxes website. Its intuitive design guides you seamlessly through the initial steps, making the start of your tax filing procedure straightforward.

Have your Cash App account details ready. Logging in connects your financial data, streamlining the tax preparation process. It’s the gateway to a hassle-free filing experience.

Entering personal information

Start by entering your personal information. This includes your legal name, address, and Social Security number. Accuracy here is crucial for your tax filings.

The system safeguards your data with top-notch security measures. You can proceed confidently, knowing your sensitive information is protected throughout the process.

Importing last year’s tax return

Importing your previous year’s tax return can significantly simplify the process. Cash App Taxes allows you to upload documents directly, ensuring an easy transition.

This step not only saves time but also increases accuracy. It ensures that your tax history is consistent and fully accounted for, laying a solid foundation for the current year’s filing.

Adding income information

Next, add your income details. This includes W-2s, 1099s, and any other income sources. Cash App Taxes simplifies this by allowing document uploads and manual entries.

Accuracy in reporting income is essential. The platform guides you through each type so that all sources are correctly reported and calculated in your tax return.

Claiming deductions and credits

Cash App Taxes helps you maximize your refund by identifying potential deductions and credits. Follow the prompts to add relevant expenses, such as education costs or donations.

The system is designed to recognize opportunities for savings. By meticulously entering your information, you can make sure you’re getting the most out of your tax return.

Reviewing and filing your return

Before submission, review your tax return carefully. Cash App Taxes provides a summary of your information, allowing you to make any necessary adjustments.

Once satisfied, proceed to file your return directly through the platform. You’ll receive confirmation of submission, marking the successful completion of your tax filing.

Sealing the deal on stress-free taxes

Cash App Taxes truly shine in the world of online tax services. Its commitment to free tax filing without hidden fees brings a refreshing change to how institutions approach this matter.

The platform’s user-friendly interface and comprehensive support make it an ideal choice for anyone looking to file their taxes with expert guidance. It’s a tax solution that delivers.

This insightful look into Cash App Taxes was brought to you by Insiderbits, aiming to provide clear, concise reviews on innovative financial solutions and technology.

Keep exploring Insiderbits for more engaging content. Dive into our collection of articles and guides, each crafted to help you understand the financial and tech landscapes better.