Navigating the financial world can be tricky, and knowing how to check your credit score is a fundamental step. With this number, you’re equipped to make informed money moves.

This easy-to-follow tutorial by Insiderbits is crafted to guide you, simplifying complex terms into a clear path forward. We demystify the process, bringing clarity to your financial health.

But that’s just the start! What secrets might your credit score hold, and how can it transform your financial future? Dive in with us and equip yourself with the knowledge that pays!

Why should you make it a habit to check your credit score?

Your credit score is the key to your finances. It influences loan approvals, interest rates, and even housing options. By checking it, you stay informed and prepared for big decisions.

Regular checks ensure your score truly reflects your credit history, keeping your financial reputation safe. It also helps to spot identity theft, since unusual drops might indicate fraud.

A good score means better-borrowing terms. It could translate into lower interest rates on loans and credit cards, saving you money. Being aware helps you maintain this advantage.

Additionally, it’s not uncommon for credit reports to contain mistakes, so when you check your credit score, you can identify them early to avoid complications.

Understanding your credit score gives you control. It helps in setting realistic goals, like buying a home or car, and shows areas to improve. It’s about taking charge of your finances.

How to conveniently check your credit score on your phone

Understanding your financial standing doesn’t require a finance degree. With just a few taps on your phone, you can easily access and monitor your credit score.

We’ve selected a few easy options to help you stay updated. Dive in to discover easy, secure ways to check your credit score and take charge of your financial health.

Check your score with credit reporting agency apps

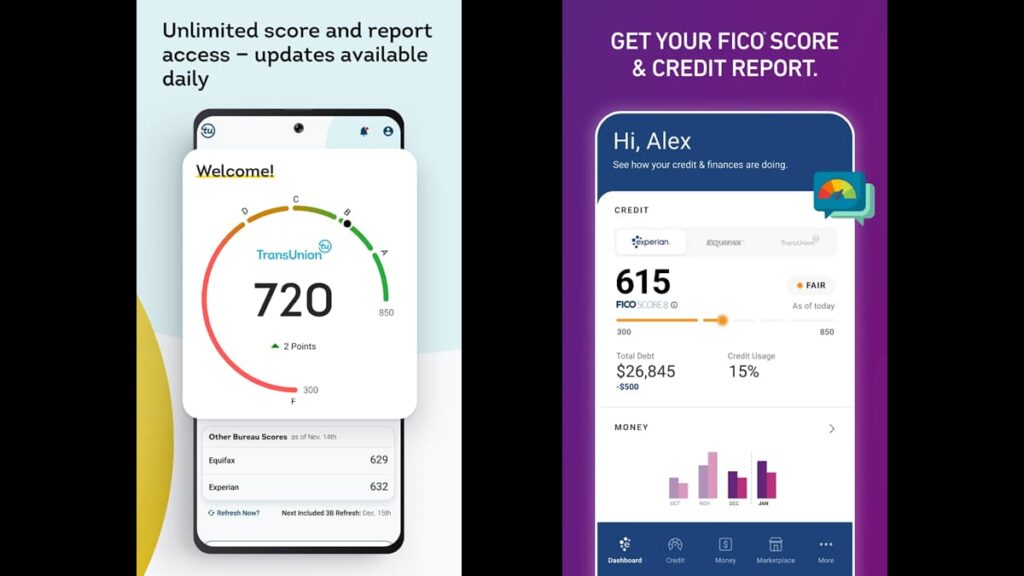

Credit bureaus like Experian, Equifax, and TransUnion have apps allowing you to check your credit score on the go. They provide up-to-date information directly from your credit files.

They also provide credit reports, alerts on changes, and advice on how to improve your score. Some features may require a subscription, but basic score checking is usually free.

Make sure to check your score with all three bureaus since each calculates it differently, and lenders might use any one of them. Monitoring it helps you get a view of your credit status.

Check your score with bank and credit card issuer apps

Your bank or credit card issuer likely offers a way to check your credit score for free through their app. However, keep in mind that you may need to opt in for this service.

These scores are updated monthly, offering a regular glimpse without negatively impacting your credit. It’s a secure method since they already have your financial information.

Remember, the scores provided might be based on one bureau’s data. For a fuller picture, consider checking your standing with the major credit bureaus directly.

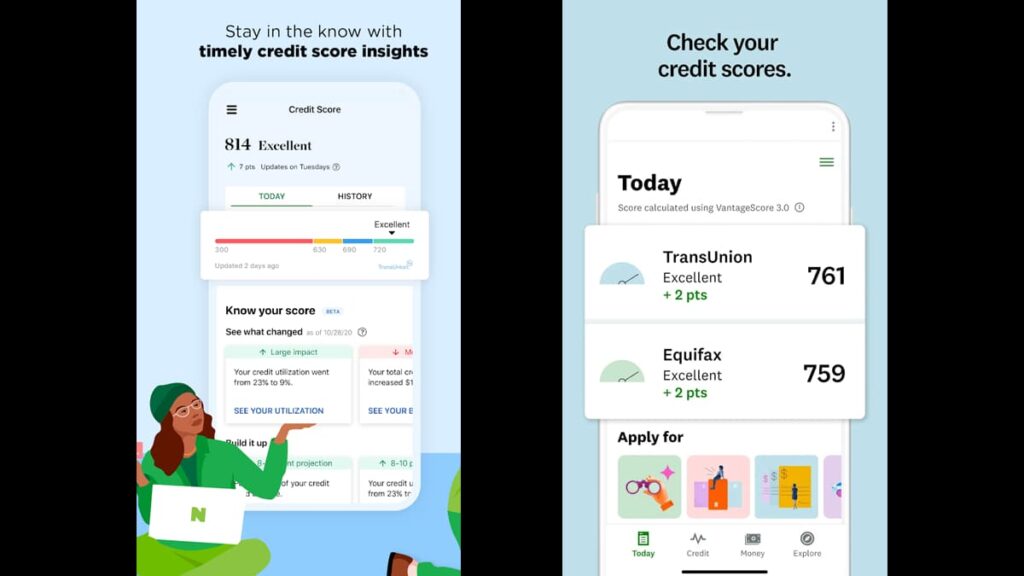

Financial service apps

Many personal finance apps provide credit score access. Services like Credit Karma or NerdWallet bundle financial data from different sources, giving you an overall assessment.

These apps make regular credit checks convenient, helping track score changes over time. Watching your score changes can provide valuable insight into your credit health.

Consulting with a credit counselor

Engaging with a credit counselor through your phone is a smart move to check your credit score. Most agencies offer online sessions, making remote consultation very practical.

Beyond just a credit check, counselors can offer in-depth insights and advice through mobile communication, helping you understand your score and plan your next steps.

This method marries convenience with personalized care. You get expert assistance remotely, helping you navigate your credit journey without needing a physical meeting.

Understanding the true significance of your credit score

Understanding credit score ranges is important as it impacts your financial options. Knowing these categories is why you should regularly check your credit score in the first place.

Facing credit difficulties: the 300 to 579 range

If your score falls between 300 and 579, it’s considered poor. At this range, getting loans can be challenging, leading to higher interest rates if approved.

It’s crucial to check your credit score frequently if it’s in this range. Early detection of issues allows you to take corrective actions, improving your future financial prospects.

Room for improvement: the 580 to 669 range

Scores between 580 and 669 are classified as fair. It means you may receive credit, but not under the most favorable terms. It’s a tipping point for creditworthiness.

Regularly check your credit score to make sure it doesn’t dip lower. Consistent monitoring helps you maintain or improve your standing, providing more financial flexibility.

Solid financial footing: the 670 to 739 range

A score within the 670-739 range is considered good. It signals to lenders you’re usually reliable, opening up better opportunities like lower interest rates on loans.

If you’re here, keep up the responsible behavior. Continue to check your credit score, ensuring it remains steady or improves, as lenders favor borrowers within this range.

A strong rating within the 740 to 799 range

Falling between 740 and 799 is considered very good. It’s achieved by long-term financial diligence and timely payments, offering you premium lending terms.

However, you should still check your credit score routinely to catch any discrepancies, even when comfortably within this range, to protect your status.

Achieving excellence: the 800 to 850 range

Ranging from 800 to 850 is basically the pinnacle of creditworthiness. You’ll enjoy the best loan terms, including interest rates, and you are seen as a low-risk borrower.

Maintaining this score is important. Regular checks ensure your credit score stays exceptional, as you have the most to lose from fraud or reporting errors.

Our final thoughts on credit score clarity

Learning how to check your credit score opens financial doors. Knowing this number and what it means is your ticket to better deals and peace of mind with money matters.

Now that you’re equipped with insights into what different scores mean, you’re ready to take control. Remember, knowledge is power, especially concerning financial health.

We at Insiderbits made this guide just for you, but there’s more to see and learn. We’re all about making money talks easy and worry-free so you can navigate with confidence.

Hungry for more knowledge? We have a feast of guides for you. Each one helps clear the fog on your financial pathway. Join us, and let’s learn together!