Zelle app speeds up the process of moving money, making it easy to transfer funds. With its partnerships across major U.S. banks, your financial transactions are in fast-forward mode.

We at Insiderbits decided to take a closer look at the app’s promise of speed and security with its fast money transfers. It’s the digital handshake in finance you’ve been waiting for?

Ever wonder how a simple tap can safely move your money? Join us as we unravel the magic behind Zelle, your miniature financial wizard. Ready for a deep dive? Let’s go!

Related: Acorns App: Grow Your Wealth with Smart Saving and Investing

An in-depth Zelle examination

Zelle is here to change how you move your money. Its integration with banks and credit unions guarantees that your transactions aren’t just quick; they’re also super safe.

Imagine needing to split dinner costs or pay your part of the rent. With Zelle, those moments are hassle-free. Money moves directly from your account to the recipient, effortlessly.

What sets Zelle apart is its ability to make financial exchanges not only fast but incredibly straightforward. You’re no longer slowed down by complex processes or waiting periods.

Safety is also a cornerstone of Zelle’s service. It’s comforting to know that when you transfer funds, it’s done with the utmost security because your peace of mind is Zelle’s priority.

Zelle simplifies the process of financial exchanges, making sending money to others as easy as sharing a photo. It’s the modern touch to managing your finances smoothly.

4/5

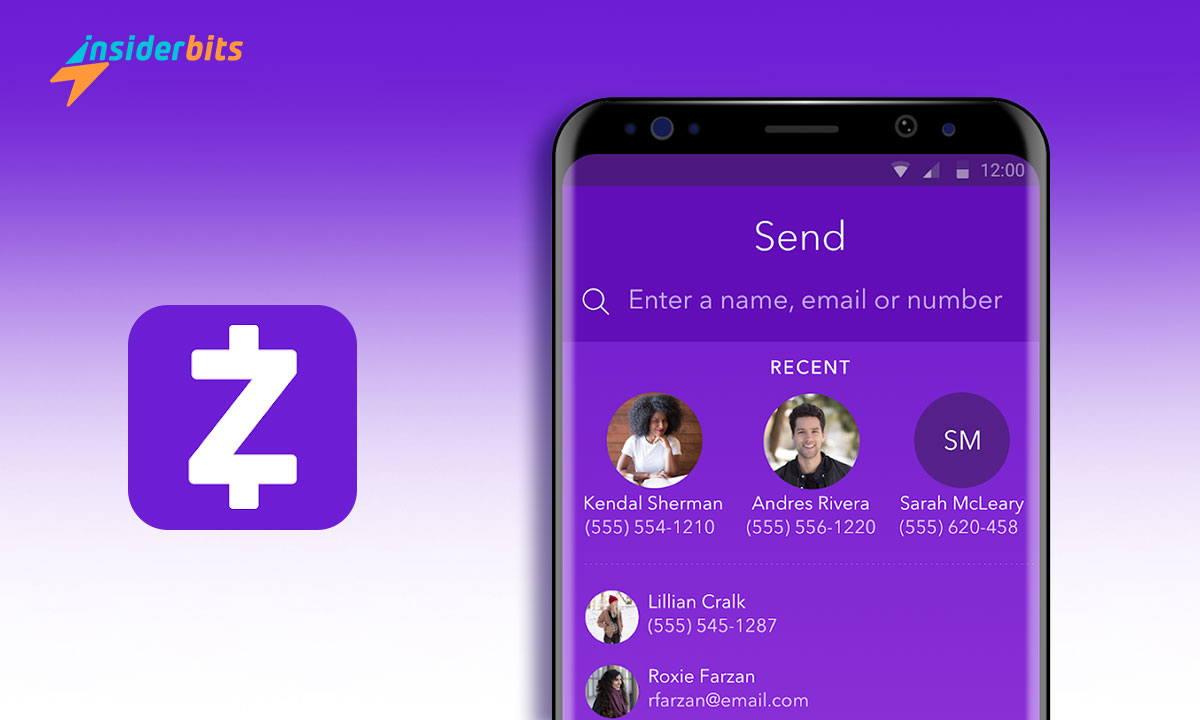

Zelle app features

Zelle makes it simpler than ever to send and receive money. With its user-friendly interface, you’ll be able to experience a combination of speed and convenience like never before.

In addition, Zelle’s collaboration with leading banks makes sure your transactions are not only fast but also safeguarded. Let’s take a closer look at some of its best features.

- Immediate Transactions: Say goodbye to waiting days for transactions. Zelle’s service moves quickly, allowing you to send or receive funds in minutes.

- No Processing Fees: Enjoy sending money without worrying about additional charges. Zelle prides itself on its no-fee approach, making it accessible for everyone.

- Direct Bank Integration: Zelle works directly with your bank, which means you can manage transactions within your existing banking app for added convenience.

- Security Measures: Zelle emphasizes safety, incorporating bank-level encryption and security measures to protect your information and money.

- Simple Interface: The app’s user-friendly interface is designed for ease of use. With clear instructions and a simple process, you can make a money transfer hassle-free.

With its swift transactions, robust security, and user-focused design, the Zelle app turns the chore of managing payments into an easy and enjoyable experience.

The app stands as proof of how technology can improve your daily financial interactions, making it a go-to choice for anyone looking to simplify their banking activities.

Correlato: Raggiungere la libertà finanziaria in un tocco con Cash App

Zelle app limitations

Even the most streamlined services have their hurdles, and Zelle is no exception. While it offers plenty of useful features, it also comes with a few limitations you should know about.

Below, we uncover some potential drawbacks of Zelle so that you are fully informed before hitting the download button on your device.

- No International Use: Zelle is designed for users within the U.S., restricting international transfers. This curbs its utility for those looking to send funds overseas.

- Cannot Cancel Sent Payments: Payments dispatched to an already enrolled Zelle recipient are irreversible. Precision and care in the details are essential.

- Risk of Scams: Zelle offers secure, quick transactions, but it’s still possible for scammers to take advantage. Only send money to familiar, trusted individuals.

- Transaction Limits: Zelle imposes daily and monthly sending limits, which can vary depending on your bank or credit union. These caps may hinder large transactions.

- Requires a U.S. Bank Account: Zelle is exclusive to individuals with a bank account in the United States, limiting its accessibility to U.S. residents only.

Zelle makes sending money swiftly, but it’s not without its quirks. From the international no-go to daily limits, these nuances remind us that no tool is a one-size-fits-all solution.

Keeping these considerations in mind lets you navigate Zelle’s waters smoothly, making the most of its convenience while staying aware of its limits and how to deal with them.

How to download Zelle

Stepping into the world of fast and safe money transfers with Zelle begins by downloading the app. Here’s the breakdown on how to get Zelle onto your smartphone:

Dispositivi Android:

- Start by launching the Google Play Store on your device.

- In the search bar at the top, type in “Zelle” to find the app you’re looking for.

- Look for the Zelle app, which is easily recognizable by its distinctive logo.

- Make sure the developer listed is “Early Warning Services, LLC”.

- Hit the “Install” button to begin downloading Zelle.

- Once installed, open the Zelle app to start setting it up.

Dispositivi iOS:

- Aprite l'App Store sul vostro iPhone o iPad.

- Use the search function at the bottom of the screen to look for “Zelle”.

- Identify the official app by its logo and developer, “Early Warning Services, LLC”.

- Tap “Get”, then enter your Apple ID password or use Face ID/Touch ID for security.

- When the installation is complete, open the Zelle app to proceed with the setup.

With these steps, you’re all geared up to enjoy the benefits Zelle offers, from a swift money transfer to enhanced security measures, all within a user-friendly interface.

4/5

Correlato: Le migliori applicazioni per il bilancio

How to efficiently navigate the Zelle app

The world of digital payments is easier with Zelle. This app not only promises speed but also upholds the highest standards of security, making every transaction worry-free.

Are you ready to simplify your financial exchanges? Follow this guide to master the Zelle app, turning inconvenient payments into effortless taps on your device.

Set up your account

After installation, open the Zelle app and you’ll be greeted with a welcome screen guiding you through the setup process. Click on “Get Started” to begin the journey of easy banking.

Key in your email or mobile number. Zelle securely links this to your bank. Accuracy is key to preventing issues and ensuring smooth account setup.

Linking your bank account to the Zelle app

Connecting your bank account to Zelle is crucial for making any transfers. This connection is what makes transactions swift. In the app, you’ll find an option to link your bank account.

Look for your bank within the provided list. If your bank isn’t listed, you can manually add your account details in no time simply by following the on-screen instructions.

Enter your banking login credentials when prompted. Zelle securely encrypts this information so that your account remains safe. After this, you can safely begin to use the app.

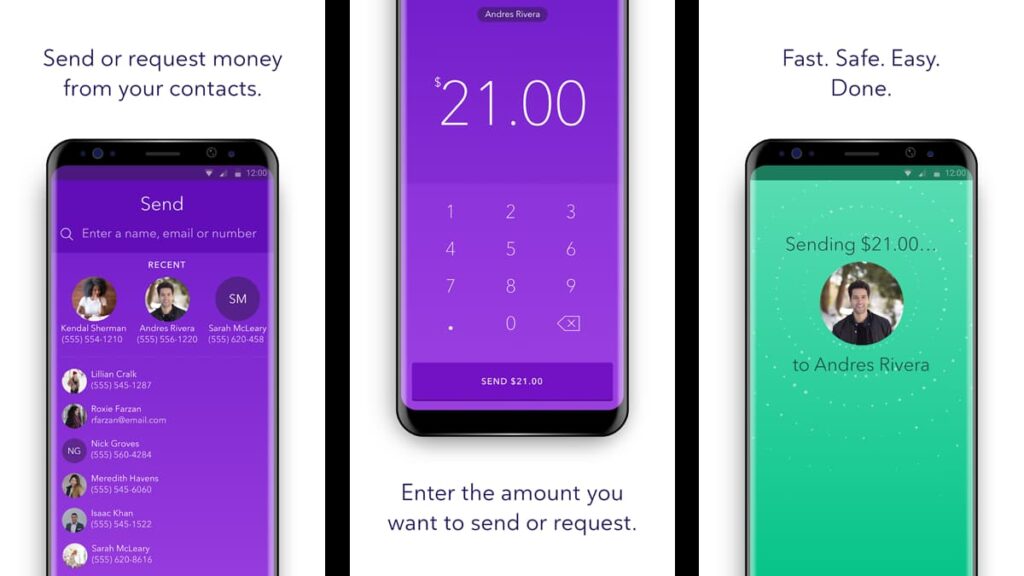

Using Zelle to send funds

To send money, choose the “Send” option within the app. This action opens up a field where you can add your recipient’s email address or U.S. mobile number.

The details you enter must be correct to ensure the money reaches the right person. After making sure everything is correct, enter the amount you want to send.

Zelle will then prompt you for a final review of the details. Once you’re sure everything is correct, confirm the transfer. The money will move quickly, often arriving in minutes.

Receiving money

When someone sends you money using Zelle, you’ll receive a notification. If it’s your first time receiving money, you may need to accept the transfer.

Follow the prompts to direct the funds to your linked bank account, and no action is needed for future transfers once your account is set up.

This means that any amount of money sent to you will automatically be deposited into your account, showcasing Zelle’s convenience and efficiency.

Concluding thoughts on Zelle’s financial elegance

Zelle redefines the ease of a simple money transfer, offering fast transactions and unparalleled security. Its approach makes sending and receiving money straightforward.

By integrating with major U.S. banks, Zelle provides a service that’s not only quick but reliable and efficient. It’s an excellent platform to help you with your money needs.

Our journey through Zelle’s capabilities, brought to you by Insiderbits, emphasizes its role as an important player in digital payments. Its transparency and lack of fees also stand out.

For more insights into the digital world, stay tuned to Insiderbits. Here, we uncover the best in tech and finance, offering tools to empower your decisions and enrich your understanding.