Are you on the lookout for Cash App alternatives? More and more people are exploring new ways to handle their money, and we have some great options that might just fit your wallet.

Brought to you by Insiderbits, this is a handy list of mobile payment apps. We’ve sifted through the options to bring you the best, focusing on special extras that make life easier.

Ready to change the way you do your financial transactions? There’s a whole world of possibilities waiting for you. Join us as we uncover the gems in the world of digital payments.

संबंधित: शीर्ष 5 व्यक्तिगत वित्त प्रबंधन मोबाइल ऐप्स

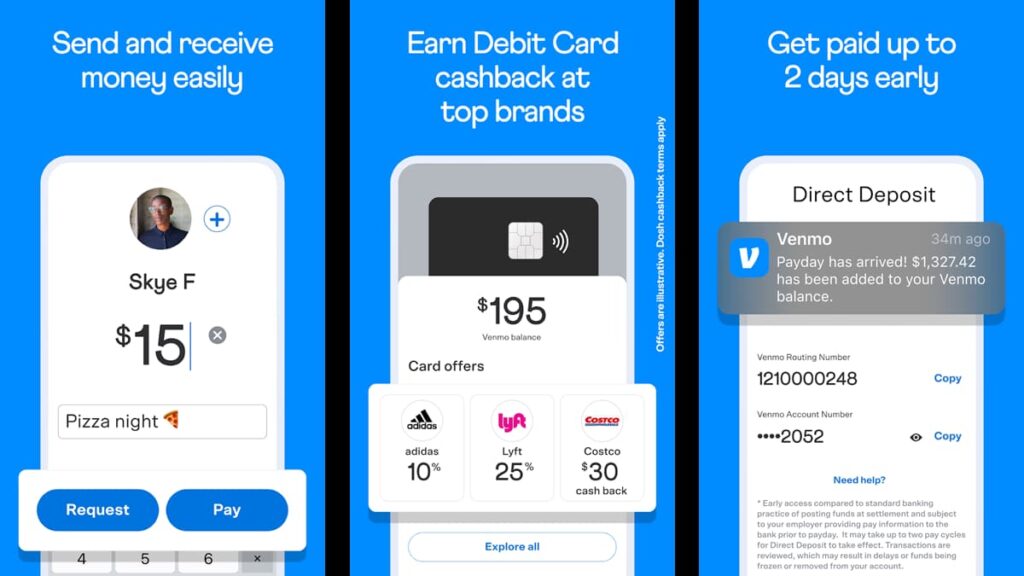

Venmo

Venmo stands out as a social, secure, and speedy way to handle your finances. With over 83 million users, it’s a community where you can pay, get paid, and connect with friends.

Whether splitting rent or gifting, Venmo makes transactions personal. Add a note to each payment, transforming the boring task of money transfer into an opportunity for connection.

The app takes the hassle out of group payments. Request money from multiple friends in one go, setting amounts for each person. It’s the perfect solution for shared expenses.

Shopping also gets rewards with the Venmo Debit Card. It’s a card that understands you, offering automatic cashback at favorite merchants, with no monthly fees.

You can also request a credit card with Venmo. Imagine earning up to 3% cash back on your top spending categories. It’s a smart way to earn rewards on everyday purchases.

Venmo highlights

- Social Payment Feature: Share and connect with friends by adding notes to payments, making money transfers more personal and engaging.

- Multiple Payment Requests: Easily request money from several friends at once, ideal for group expenses and shared activities.

- Venmo Debit Card: Enjoy automatic cashback when shopping with the Venmo Debit Card, with no monthly fees or minimum balance required.

- Rewards with Venmo Credit Card: Earn up to 3% cash back on eligible spending categories, enhancing everyday purchases with financial benefits.

- Cryptocurrency Access: Buy, hold, and sell cryptocurrency directly in the app, making it a user-friendly option for beginners in the crypto world.

Venmo hiccups

- Limited International Use: Venmo is primarily available in the United States, limiting its functionality for international transactions.

- Transaction Fees: Instant transfers to bank accounts and credit card payments incur fees, which might add up over time.

- सुरक्षा की सोच: Default public transaction settings can raise privacy issues; users need to manually change settings for more privacy.

- Spending Limits: There are weekly spending limits, which might not suit users with high-volume transactions.

- Competitive Market: As a part of Cash App alternatives, Venmo faces tough competition, which may influence its feature updates and user experience.

संबंधित: 5 Best Bill-Splitting Apps For Error-Free Expense Sharing

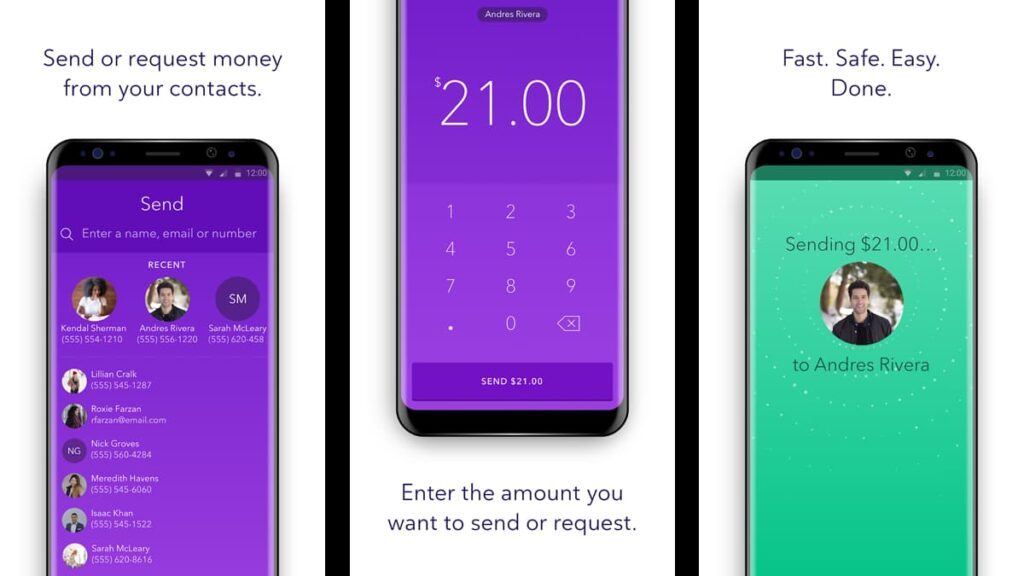

Zelle

Zelle revolutionizes the way you send money, partnering with U.S. banks and credit unions for a seamless transaction experience. It’s fast, secure, and offers easy integration.

With Zelle, all you need is the recipient’s email address or U.S. mobile number. It’s a straightforward and safe way to settle up without the hassle of cash or checks.

The app shines among Cash App alternatives and mobile payment apps by charging no fees for its services, though standard mobile carrier or bank fees may still apply.

Starting with Zelle is simple as well. Whether you have the app or use your bank’s platform, enrollment is simple with your Visa or Mastercard debit card linked to a U.S. account.

Sending money with Zelle is super quick. If your recipient is already enrolled, they’ll typically receive funds in minutes, making it a reliable and efficient way to transfer funds.

Zelle highlights

- Integrated with Banks: Zelle partners with U.S. banks, offering a secure and familiar platform for users who prefer banking integrations.

- Quick Transactions: Money is transferred within minutes between bank accounts, making Zelle a fast solution for immediate needs.

- No Fees for Service: Zelle does not charge additional transaction fees, appealing to users seeking cost-effective solutions.

- Ease of Use: Simple enrollment and user-friendly interface, allowing transactions with just an email address or U.S. mobile number.

- Widely Accepted: Zelle’s partnership with numerous banks makes it a widely accepted payment method, enhancing convenience for users.

Zelle hiccups

- Limited to U.S. Accounts: Zelle is restricted to users with U.S. bank accounts, limiting its international transaction capabilities.

- No Payment Protection: Unlike some mobile payment apps, Zelle offers no protection for payments made to wrong or fraudulent parties.

- No Credit Card Linking: Zelle does not allow transactions through credit cards, which might limit flexibility for some users.

- No Wallet Feature: Unlike other apps, Zelle doesn’t hold money in an app wallet, requiring immediate withdrawal to a linked bank account.

- Dependent on Bank Participation: If a recipient’s bank isn’t part of Zelle’s network, the process of receiving money can be less straightforward.

संबंधित: आपके वित्तीय स्वास्थ्य को बढ़ावा देने के लिए शीर्ष 10 बजट-ट्रैकिंग ऐप्स

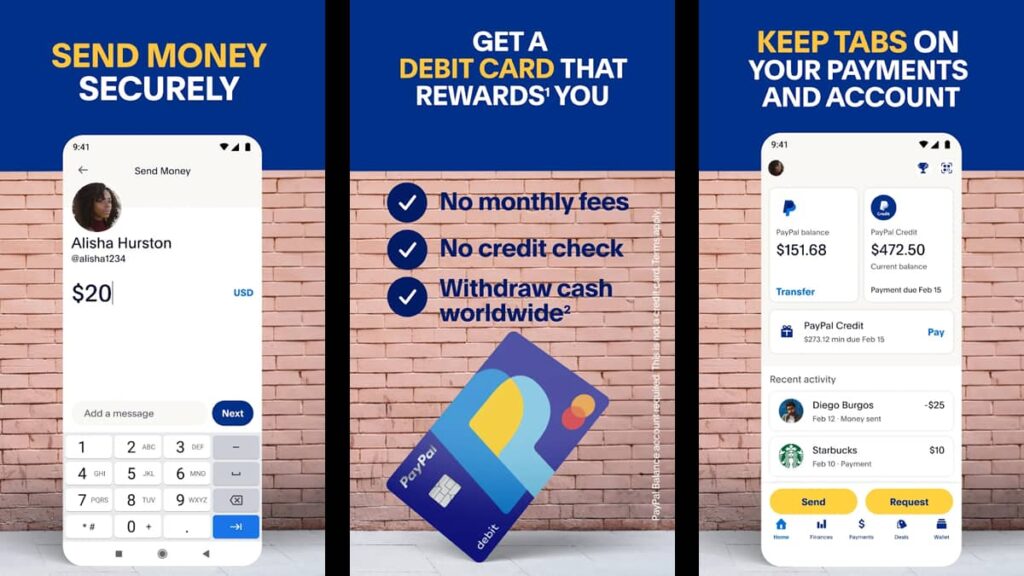

PayPal

PayPal offers a comprehensive way to manage money. It’s not just for sending or receiving payments; it’s also about discovering cashback offers and efficiently handling your finances.

Sending and requesting funds is free with PayPal when using a bank account or PayPal balance. It’s a cost-effective way to settle up with friends or family in the U.S.

But that’s not nearly all. PayPal’s “Pay in 4” feature provides a twist in mobile payment apps. It allows you to split purchases into four payments, making big expenses more manageable.

The PayPal Debit Card also opens up new possibilities. Transfer funds easily from your bank to your PayPal balance and use the card anywhere Mastercard is accepted, even at ATMs.

Finally, security is a cornerstone of PayPal. With advanced encryption and fraud protection, you can trust that your financial transactions and information are handled with utmost care.

4.2/5

PayPal highlights

- विश्वव्यापी पहुँच: PayPal is widely accepted worldwide, making it ideal for international transactions and purchases from various online merchants.

- Free Personal Transactions: Sending and requesting money is free within the U.S. when using a bank account or PayPal balance.

- PayPal’s “Pay in 4”: Split your online purchases into four interest-free payments, providing flexibility and ease in managing finances.

- Cashback Offers: Discover a range of cashback offers from popular brands, allowing you to save money on purchases you already make.

- PayPal Debit Card: Access your PayPal balance with ease, use it anywhere Mastercard is accepted, and withdraw cash without fees at over 37,000 ATMs.

PayPal hiccups

- Fees for Business Transactions: PayPal charges fees for business transactions, which can add up for small businesses or freelancers.

- Currency Conversion Fees: International transactions may incur currency conversion fees, increasing the cost of sending money abroad.

- Account Freezing Issues: PayPal has been known to freeze accounts for security reasons, which can be a significant inconvenience.

- Transaction Fees with Credit Cards: Sending money using a linked credit card incurs fees, unlike some other Cash App alternatives and mobile payment apps.

- Dispute Resolution Process: Resolving disputes through PayPal can be lengthy and complex, which may be challenging for users facing transaction issues.

संबंधित: PayPal Honey App: Your Guide to Smart Spending

What are mobile payment apps?

Mobile payment apps are digital tools that allow you to send and receive money using your smartphone. They make transactions quick, easy, and often just a tap away.

These apps can link to bank accounts, credit cards, or digital wallets, enabling users to pay for services, split bills, or transfer money to friends and family with ease and convenience.

In the realm of Cash App alternatives and mobile payment apps, users have a variety of choices. Each app comes with unique features like rewards, or even investment options.

Are mobile payment apps safe?

When considering mobile payment apps, safety is a crucial concern. These apps use advanced technology, but users often wonder about the reliability of these digital platforms.

Most mobile payment apps employ strong encryption and fraud detection systems. They protect user data and transactions to prevent unauthorized access and financial losses.

However, like all digital tools, they are not immune to risks. You should always be cautious, using safe practices like strong passwords and avoiding public Wi-Fi for transactions.

While these apps offer convenience, it’s important to use them wisely. Regular updates, secure networks, and being alert to scams are key to safely enjoying their benefits.

संबंधित: व्यक्तिगत वित्त सीखने के लिए सर्वश्रेष्ठ ऐप्स

Closing thoughts on the best mobile payment apps

Our walkthrough of Cash App alternatives has come to an end. We’ve explored fantastic options, each with unique features that cater to different needs and preferences.

From Venmo’s social connectivity to Zelle’s straightforward simplicity, we’ve covered a spectrum of options that changed how people do financial transactions.

This insightful list by Insiderbits showcases the diversity and innovation in the world of mobile payment apps, offering a gateway to financial empowerment.

As you navigate the digital era of money transfers, we invite you to look at our other articles. Discover more tools, tips, and trends that can improve your financial journey with us!