In today’s digital era, Cash App stands out, redefining how we view and handle money. It’s more than an app—it’s a lifestyle shift in the world of finance.

Insiderbits took the app for a spin, and we were truly impressed. Beyond its sleek design, Cash App offers a user experience that’s genuinely next-level

But there’s more beneath its innovative interface. Ready to uncover hidden gems and redefine your financial journey? Let’s dive deeper into the world of Cash App.

Cash App: an overview

Say hello to Cash App, where finances evolve with technology. Here, physical cash and tedious transactions take a backseat, giving way to simplified banking.

The app stands out with its user-centric design. With its intuitive interface and easy navigation, every transaction is smooth and uncomplicated.

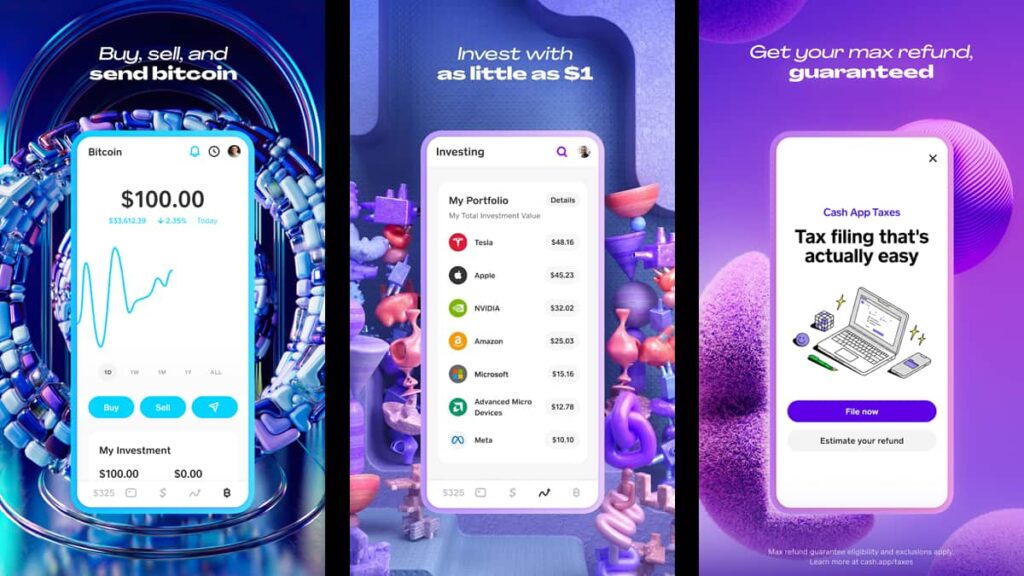

Think beyond just transfers: Cash App doubles as an investment portal. Ever thought of buying stocks or Bitcoin? Now you can start investing like a pro with minimal effort.

If you’re tired of waiting for payday, Cash App can help. Receive your paycheck 2 days in advance through the app, giving you early access to your hard-earned money.

And it’s not just about digital either! You can request a Visa debit card within the app and shop online instantly with your virtual card, making every purchase hassle-free.

Besides, with their Boost feature, you can get exclusive discounts at your favorite outlets. Imagine a digital coupon book, is always ready to surprise you!

With all these features, safety is a priority. Cash App ensures your funds are guarded by the latest encryption tech. Coupled with Face and Touch ID, your assets are in a digital fortress.

4.6/5

Cash App’s main features

When it comes to digital transactions, Cash App emerges as a revolutionary tool, reshaping how we perceive and handle money.

With just a few taps, you can effortlessly juggle a multitude of financial tasks, making these once-time-consuming chores a lot easier. Here are the app’s main features:

- Seamless Peer-to-Peer Transactions: Experience the convenience of instantly transferring funds between friends, family, or anyone registered on Cash App.

- Personalized Cash Card Experience: Get a uniquely designed debit card, offering you the freedom to access and spend your Cash App credits at a series of outlets.

- Boosts: Enjoy instant discounts when using the Cash Card at selected merchants or categories.

- Bitcoin Purchase: Dive into cryptocurrency by purchasing, holding, and selling Bitcoin directly within the app.

- Investing: Start your investment journey by buying stocks in your favorite companies, with as little or as much money as you want.

- Cash App Pay: A contactless payment solution for businesses, making the transaction process seamless and efficient.

- Free ATM Withdrawals: With the Cash Card, you can enjoy free ATM withdrawals after meeting certain conditions.

- Connect Your Bank: Easily integrate your banking details to facilitate smooth transactions with your Cash App.

- Direct-to-App Deposits: Conveniently receive paychecks, tax refunds, and various other direct deposits directly into your account balance.

- International Payments: Send money to friends and family, even if they’re in different countries.

- Virtual Card: Even without the physical Cash Card, make secure online transactions using a virtual card number.

Expanding the horizons of what a digital wallet can offer, Cash App paves the way for a new age of financial management.

From quick peer-to-peer transfers to stepping into the realm of cryptocurrency, it’s not just a transactional tool—it’s a financial Swiss Army knife.

Cash App’s main benefits

Imagine an app that truly understands your needs, habits, and aspirations. With Cash App, you’re not just managing funds; you’re unlocking a world of opportunities tailored just for you.

From fostering financial independence to simplifying social interactions, the advantages of the app can touch every corner of your life. How? Learn the benefits below:

- Financial Autonomy: Gain a sense of control and independence over your spending and saving habits.

- तनाव में कमी: The ease of use reduces the anxiety tied to traditional banking experiences and unexpected expenses.

- Instant Gratification: Whether it’s a last-minute gift or an urgent bill, get things done immediately.

- Enhanced Social Relations: No more awkward conversations about owed money; settle it on the spot.

- Achieving Financial Goals: Whether it’s a dream vacation or a down payment, every transaction brings you a step closer.

- Personal Growth: With easy financial management, focus more on self-development and less on money-related concerns.

- Sense of Security: Know that your finances are safe, accessible, and working for you round the clock.

Cash App provides an avenue for genuine financial empowerment. With each interaction, you can explore opportunities for growth, independence, and flexibility.

The app goes beyond the present, shaping a future where your financial goals align seamlessly with your personal aspirations.

Cash App’s limitations

Cash App has undoubtedly brought a revolution in peer-to-peer payments and money management. However, the app isn’t free of its limitations.

Even though the app is versatile, it has a transfer limit. A $1,000 limit might feel restricting when attempting large transactions, which in turn might prompt you to seek help elsewhere.

Although Cash App is rising in popularity, it isn’t universally accepted. Not all merchants recognize it, limiting its utility as a universal payment tool.

Additionally, international transfers are also limited. Unlike some platforms with global reach, Cash App restricts users to the U.S. and UK, hindering worldwide use.

Is Cash App safe?

With digital transactions becoming a daily norm, everyone is rightfully concerned about the safety of their banking platforms. Especially with cyber-attacks becoming so common.

Cash App employs multiple security layers, including encryption and fraud detection, to ensure users’ money and data remain protected.

The app offers optional security features such as PIN entry, Touch ID, or Face ID verification, adding an extra layer to give you peace of mind.

How to download the Cash App

Ready to dive into the world of convenient money transfers? Whether you’re aligned with Team Android or Team iOS, downloading Cash App is a straightforward process.

Below, we’ll provide a simplified guide to make sure you have a hiccup-free experience from start to finish. Read on to get all the details!

Android Devices:

Locate and tap the Play Store icon, typically found on your device’s home screen or in the app drawer.

At the top of the screen, you’ll see a search bar. Type “Cash App” into this bar and tap the search or magnifying glass icon.

Among the search results, find the Cash App with the green icon and a white dollar sign, which is the official logo.

Once you’ve selected the official Cash App listing, tap the “Install” button. Your device will download and automatically install the app.

After installation, click “Open”. The app will lead you through the process of setting up an account or logging into an existing one.

iOS Devices:

Locate the App Store’s blue icon on your iPhone or iPad and tap to open. At the bottom of the screen, tap on the magnifying glass labeled “Search”.

In the search bar that appears, type “Cash App”. Then, in the search results, find the official Cash App.

Tap the “Get” button next to it. Depending on your settings, you might be prompted to input your Apple ID password or authenticate the download with fingerprint or face ID.

Once downloaded, the Cash App icon will appear on your home screen. Tap to launch the app. On the first run, it will guide you through account creation.

4.6/5

Navigating Cash App

Cash App offers an intuitive platform for money transfers, investments, and more. When you’re just getting started, understanding the app’s layout can optimize your experience.

Even though the app does not provide a tutorial, Insiderbits is here to give you a detailed guide so you can navigate through its many functionalities.

अपना खाता बनाना

Once you have the app, open it and enter your mobile number or email. You’ll receive a confirmation code for verification.

After entering this code, link a bank account using your debit card details, and set up your unique $Cashtag identifier. You’re now ready to explore.

Dashboard Overview

After setting up your profile, you’re introduced to the main dashboard. It prominently displays your available balance.

This centralized hub gives a clear overview, making it easy to check your financial standing and access the main functions.

Initiating Transfers

Want to send funds? Simply tap on the green “Pay” button. Input the desired amount and then fill in the recipient’s details.

This can be their phone number, email, or unique $Cashtag identifier. Add a note for reference, then confirm the transaction to send.

Receiving Funds

For incoming transactions, your unique $Cashtag serves as a personalized identifier. Share this, or your linked email or phone, with the sender.

When funds are transferred, you’ll get a notification, and your main balance will reflect the new amount.

Managing Your Debit Card

Within Cash App, there’s a dedicated section for your Cash Card, which is a customizable Visa debit card.

By selecting the card-shaped icon, you can request your card, activate it when it arrives, set or change your PIN, and view transactions.

Before your physical card arrives, you can access and use your virtual card for online purchases.

Setting Up Early Pay

For the perk of receiving paychecks early, head to the “Banking” tab. Here, the “Direct Deposit” option provides account and routing numbers.

Share these with your employer or payroll provider. By doing so, eligible deposits can reach you up to 2 days earlier than many traditional banks.

Stocks & Bitcoin Trading

The stocks/bitcoin tab in the bottom menu is your portal to investment possibilities. Here, you can delve into the world of stock trading or explore the realm of cryptocurrencies like Bitcoin.

With user-friendly interfaces and real-time price tracking, you can initiate trades, whether buying or selling, seamlessly.

Even if you’re new to the investment scene, Cash App allows you to start with as little as $1, making it accessible for all.

Additional Features and Settings

In the top right corner, you’ll spot a profile icon. Tapping this reveals various settings and additional features.

Here, you can adjust privacy settings and access special discount offers known as “Boosts”. You also have the option to turn on “Dark Mode”.

Cash App: The Digital Wallet Revolution

Cash App is the future of finance, right at your fingertips. This pocket powerhouse redefines money management, combining traditional and innovative, all in one.

With its user-centric design, the app delivers a unique experience. The Visa debit card, investments tab, and unbreakable security make it a safe bet in the world of digital finance.

Impressed by Cash App? There’s much more to discover. At Insiderbits, we spotlight groundbreaking tech and sift through the noise so you don’t have to.

From in-depth reviews to expert analyses and detailed tutorials, we’re here to help you stay informed and empowered. Join our community and let’s explore the future together!