Investing is the best method to put your money to work for you, as you work to earn more of it. However, investing can be tough for beginners, with an enormous variety of possible assets to add to a portfolio.

The good news is that there are many apps available to help beginners learn and make investing easier.

In this article, Insiderbits will explore Robinhood, the best app to learn how to invest and how to get started with investing.

Let’s begin!

Robinhood Investing App Review

Robinhood is a popular stock trading app that has made investing more accessible and affordable for millions of users. With a user-friendly interface and a wide range of investment options, Robinhood has become a go-to platform for many young and first-time investors.

By using Robinhood, you can take control of your financial future and start investing with confidence, even if you have limited experience or funds. The platform’s user-friendly interface, fractional shares, and customizable purchasing process make it an excellent starting point for anyone looking to learn about investing and build a diversified portfolio.

So, if you’re ready to take the first step towards investing, Robinhood can be a valuable tool to help you get started on the right foot.

Key aspects of Robinhood include:

Ease of use: Opening an account with Robinhood is as simple as being 18 years or older, having a valid Social Security number, and providing a few personal details

Fractional shares: Robinhood allows users to buy fractional shares of stocks and exchange-traded funds (ETFs) with as little as $1, making it possible for even those with limited funds to start investing

Customizable purchasing process: Users can choose to trade stocks either in dollar amounts or share amounts, giving them flexibility in their investment decisions

Wide range of investment options: Robinhood offers a variety of investment options, including stocks, bonds, ETFs, and cryptocurrencies, allowing users to diversify their portfolios

Robinhood Learn: The platform provides a comprehensive learning center with resources and guides to help users understand the ins and outs of investing, stocks, options trading, and risk management

How to Download Robinhood Investing App – Step by Step

To download the Robinhood investing app on Android and iOS, follow these steps:

For Android:

- Open the Google Play Store on your Android device.

- In the search bar, type Robinhood: Stocks & Crypto and select the app from the search results.

- Tap Install to download and install the app on your device.

For iOS:

- Open the App Store on your iOS device.

- In the search tab, type Robinhood: Investing for All and select the app from the search results.

- Tap Get and then Install to download and install the app on your device.

4.1/5

How to use Robinhood Investing App Functions – Step by Step

To use the Robinhood investing app, follow these step-by-step instructions:

1. Getting Started

- Download the Robinhood app from the Google Play Store for Android or the App Store for iOS

- Open the app and follow the prompts to create an account by providing a valid Social Security Number and a U.S. address

2. Funding Your Account

- Deposit funds into your account to start investing. The app will guide you through the process of linking your bank account and transferring money

3. Exploring the App

- Familiarize yourself with the app’s user-friendly interface, which is designed to simplify the investment process for new traders

- Take advantage of the app’s easy-to-use mobile features, making it an excellent platform for beginners

4. Making Investments

- Start investing by purchasing stocks, options, ETFs, or cryptocurrencies directly from the app

- Consider investing a small amount of money that you are comfortable with losing, especially if you are new to investing

5. Research and Education

- Utilize the limited research functionality within the app and consider seeking additional information from external source

- Consider using a stock market simulator to create a “practice portfolio” to learn how the market fluctuates over time

What are the Benefits of Using Robinhood for Investing

The benefits of using Robinhood for investing include:

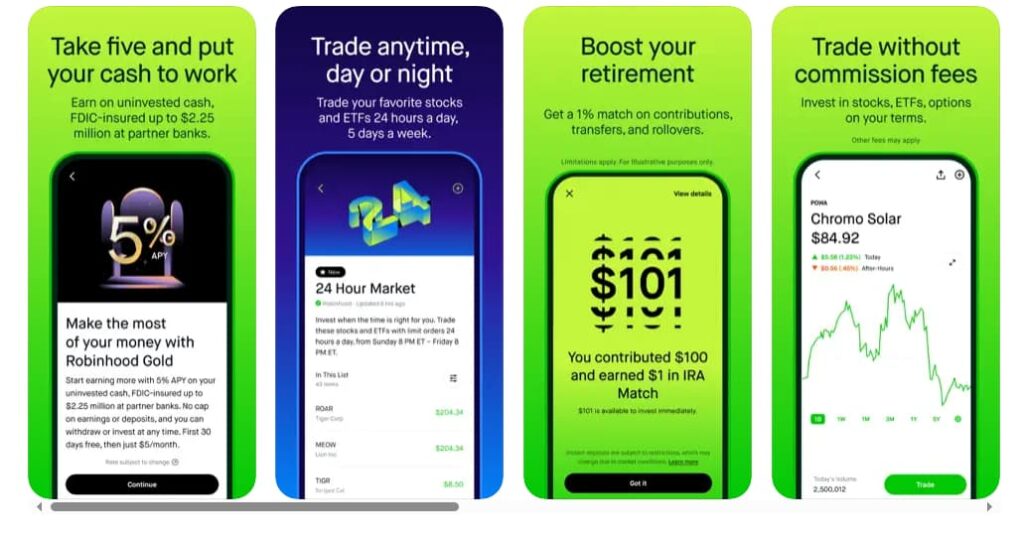

Commission-free trading: Robinhood offers 100% commission-free stock, options, ETF, and cryptocurrency trades, making it an attractive option for investors who trade frequently

User-friendly interface: The platform is known for its easy-to-use, streamlined design, allowing users to seamlessly enter, exit, and monitor positions

No account minimums or monthly fees: Robinhood does not require a monthly fee or account minimum, making it accessible to a wide range of investors

Cryptocurrency trading: Robinhood supports trading of various cryptocurrencies, making it a convenient option for investors interested in digital assets

Advanced charting features: The platform offers advanced charting features, such as technical indicators like moving averages, which can help investors analyze market trends

24/7 trading: Robinhood allows trades to be made at any time between 8 p.m. Eastern time on Sunday and 8 p.m. on Friday, accommodating investors with diverse schedules

Tips to Make Investing Easier

Here are some tips to make investing easier:

1. Invest Early and Regularly

Take advantage of compounding by starting to invest early and regularly to build wealth over time

2. Establish Clear Investment Goals

Set clear investment goals aligned with your financial objectives to guide your investment strategy

3. Research Your Investment Options

Research different investment options and understand the risks associated with various assets to make informed decisions

4. Choose the Right Tools and Platforms

Select investment techniques and platforms that maximize convenience and minimize costs to simplify the investment process

5. Diversify Your Investing Portfolio

Spread risk and potentially improve returns by diversifying your investments across different asset classes

6. Manage Your Investing Portfolio Efficiently

Use tools such as automated deposit schedulers and portfolio management features to efficiently oversee your assets

7. Get Your Finances in Order

Before investing, ensure your finances are in order and understand how much money you have available to invest

8. Review Your Strategy Regularly

Regularly review your investment strategy to ensure it remains aligned with your goals and risk tolerance

By following these tips, investors can navigate the complexities of the investment landscape more effectively and make informed decisions to achieve their financial goals.

4.1/5

Robinhood App: Your Easy Guide to Start Investing Today – Conclusion

In conclusion, the Robinhood investing app provides a simple and accessible platform for users to engage in commission-free trading of various financial instruments.

While it offers a range of benefits, users should also be mindful of its limitations and consider their individual investment needs and preferences.

Still, for those looking to enter into the world of investing without significant financial commitments, this investing app can serve as a valuable starting point, providing an introduction to the market and its dynamics.

Related: The Best Apps to Learn Personal Finances

Like this article? Add the Insiderbits blog to your favorites and visit us whenever you want to learn new and exciting information about technology and much more!