What You'll Learn

Important updates are coming to Social Security in 2025 that could directly impact your monthly benefits. From COLA increases to new income limits, these changes affect millions of Americans.

- How the 2.5% COLA increase translates to real dollars in your monthly payment

- New income thresholds that let you work without losing benefits

- Supplemental Security Income (SSI) enhancements and who qualifies

- Strategic timing tips to maximize your retirement benefits

- Critical dates and deadlines you can’t afford to miss

Understanding these changes now could mean hundreds more dollars in your pocket each month.

TIP: DON'T LEAVE MONEY ON THE TABLE

The average retiree misses out on $111,000 in lifetime benefits simply by not knowing all the rules. Our complete guide ensures you claim every dollar you’re entitled to.

What You’ll Need

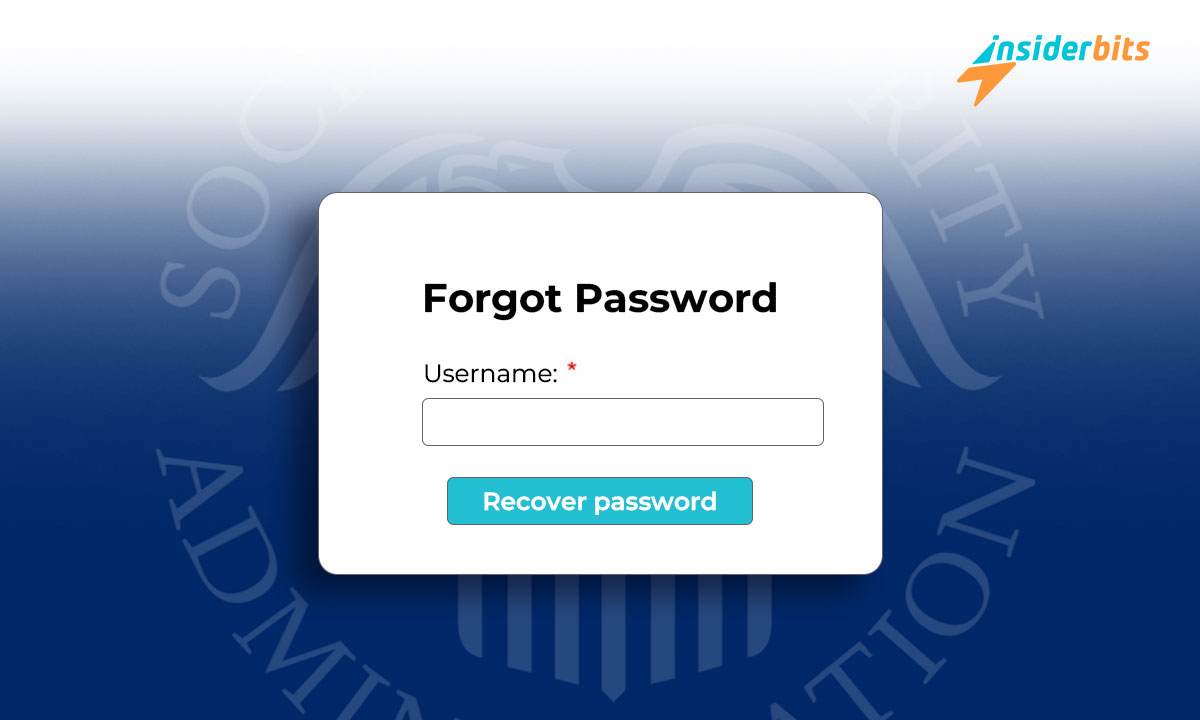

Your Social Security Account

Access your personal SSA.gov account to check your current benefits and earning history

2024 Tax Documents

Have your recent tax returns ready to calculate how the new income limits affect you

Birth Certificate or Valid ID

Required to verify your age for retirement eligibility and benefit calculations

Work History Records

Ensure all your earnings from the last 35 years are properly credited

Benefit Calculator

Use the SSA’s official tool or our guide to compare different claiming strategies

Who Will Benefit?

These Social Security changes matter most for Americans planning their financial future. Whether you’re already receiving benefits or approaching retirement, this information is crucial.

- Current retirees who want to understand how the 2.5% increase affects their budget

- Early retirees who need to know the new $23,400 income limit rules

- SSI recipients who qualify for increased supplemental payments up to $967 monthly

- Workers aged 55+ who are strategizing the best time to claim benefits

- Anyone caring for elderly parents who depend on Social Security income

WARNING: TIMING MATTERS FOR YOUR BENEFITS

Claiming Social Security at the wrong time could cost you thousands. The difference between claiming at 62 versus 70 can mean $100,000+ over your lifetime. Our detailed guide shows you exactly when to file based on your specific situation.

Conclusion

Will these Social Security changes help or hurt your retirement plans? The 2025 updates bring both opportunities and challenges that require strategic planning. Every month you wait could mean more or less money in your pocket. Don’t let confusion cost you benefits you’ve earned. Get the complete breakdown of all changes and learn exactly how to maximize your Social Security income now!

FAQ

How much will my Social Security increase in 2025?

The Cost-of-Living Adjustment (COLA) is 2.5% for 2025, meaning the average monthly benefit increases by about $49. Your exact increase depends on your current benefit amount. See our calculator for personalized estimates.

Can I work while receiving Social Security benefits?

Yes! The 2025 income limits allow you to earn up to $23,400 annually if you’re under full retirement age. Those reaching full retirement age can earn up to $62,160. Learn the specific rules for your situation.

What's changing for Supplemental Security Income (SSI)?

Individual SSI payments increase from $943 to $967 monthly, while couples see an increase from $1,415 to $1,450. Additional state supplements may apply. Check our guide for qualification requirements.

When should I start claiming Social Security?

The optimal claiming age varies by individual circumstances. Delaying from 62 to 70 can increase benefits by up to 77%. Our comprehensive guide helps you calculate your best strategy.

Will Medicare premiums affect my increase?

Medicare Part B premiums typically offset some of the COLA increase. Most beneficiaries will still see a net increase in 2025. Get the exact numbers and learn protection strategies.

Do these changes affect disability benefits?

Social Security Disability Insurance (SSDI) recipients receive the same 2.5% COLA increase. Work incentive rules also change. See our complete disability benefits update.